Website To Check Property Owner

How to Find Out Who Owns a Property: 18 Ways in 2026

How to Find Out Who Owns a Property: 18 Ways in 2026 ... Finding property owners in 2026 is easier than ever thanks to online databases and public records.

https://www.amerisave.com/learn/how-to-find-out-who-owns-a-property-ways-inProperty Tax Record Search - Town of Huntington, Long Island, New York

Rate this translation Your feedback will be used to help improve Google Translate...

https://www.huntingtonny.gov/taxlookup

What free app do you use that shows property owners and ...

Is there a cheap way to see the IP address of visitors to you blog/website? ... . All rights reserved. Expand Navigation. Expand Navigation.

https://www.reddit.com/r/metaldetecting/comments/1bczobm/what_free_app_do_you_use_that_shows_property/STAR eligibility

STAR eligibility Eligible homeowners Some factors that help determine whether a property is your primary residence include: - voting, - vehicle registrations, and - length of time spent each year on the property. The Tax Department may also request proof of residency.

https://www.tax.ny.gov/pit/property/star/eligibility.htm

actDataScout - County / Parish Sponsored Public Records

- DataScout. All Rights Reserved. ×. Accessibility. It is our intent to comply with the website accessibility standards suggested by the ADA, and ...

https://www.actdatascout.com/Transparency

Property Tax New Jersey's property tax is assessed on an annual basis by the local assessor then submitted to their county board of taxation. This data contains the collection of those lists filed in January of each new calendar year. Any changes, like ownership transfer, that occur after that date will not be reflected in this file.

https://www.nj.gov/transparency/property/

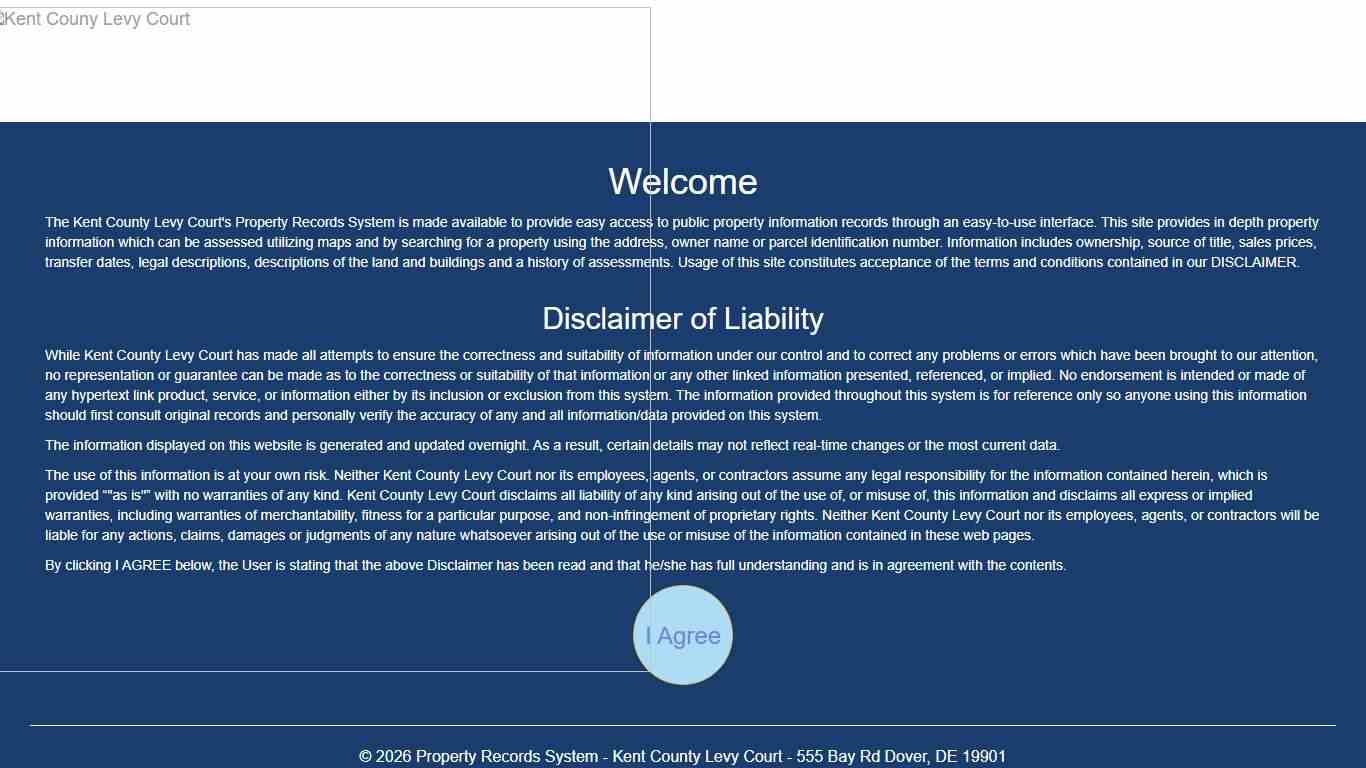

Kent County Levy Court - Property Records System

Welcome The Kent County Levy Court's Property Records System is made available to provide easy access to public property information records through an easy-to-use interface. This site provides in depth property information which can be assessed utilizing maps and by searching for a property using the address, owner name or parcel identification number.

https://www.kentcountyde.gov/My-Government/Records-Search/Search-Property-Records-in-Kent-County

How to find the owner of a recently sold home if you use Zillow to search for homes by price range - Quora

Yes. You should worry. For several reasons: First, as has been noted, all those sites use algorithms based not only on what they consider comps (they’re often wrong about what’s a comps—that’s another problem), but those algorithms are based on a collection of data.

https://www.quora.com/How-can-you-find-the-owner-of-a-recently-sold-home-if-you-use-Zillow-to-search-for-homes-by-price-range

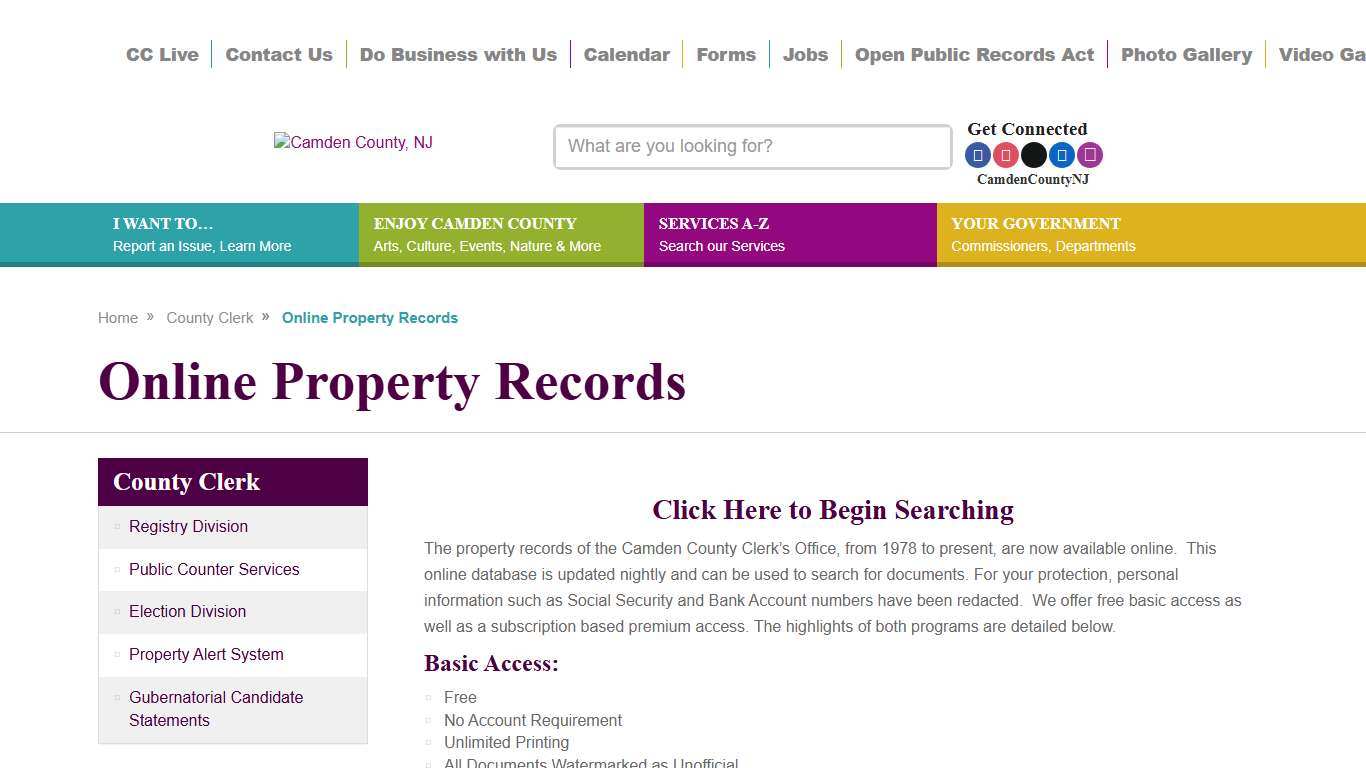

Online Property Records Camden County, NJ

The property records of the Camden County Clerk’s Office, from 1978 to present, are now available online. This online database is updated nightly and can be used to search for documents. For your protection, personal information such as Social Security and Bank Account numbers have been redacted.

https://www.camdencounty.com/service/county-clerk/online-property-records/

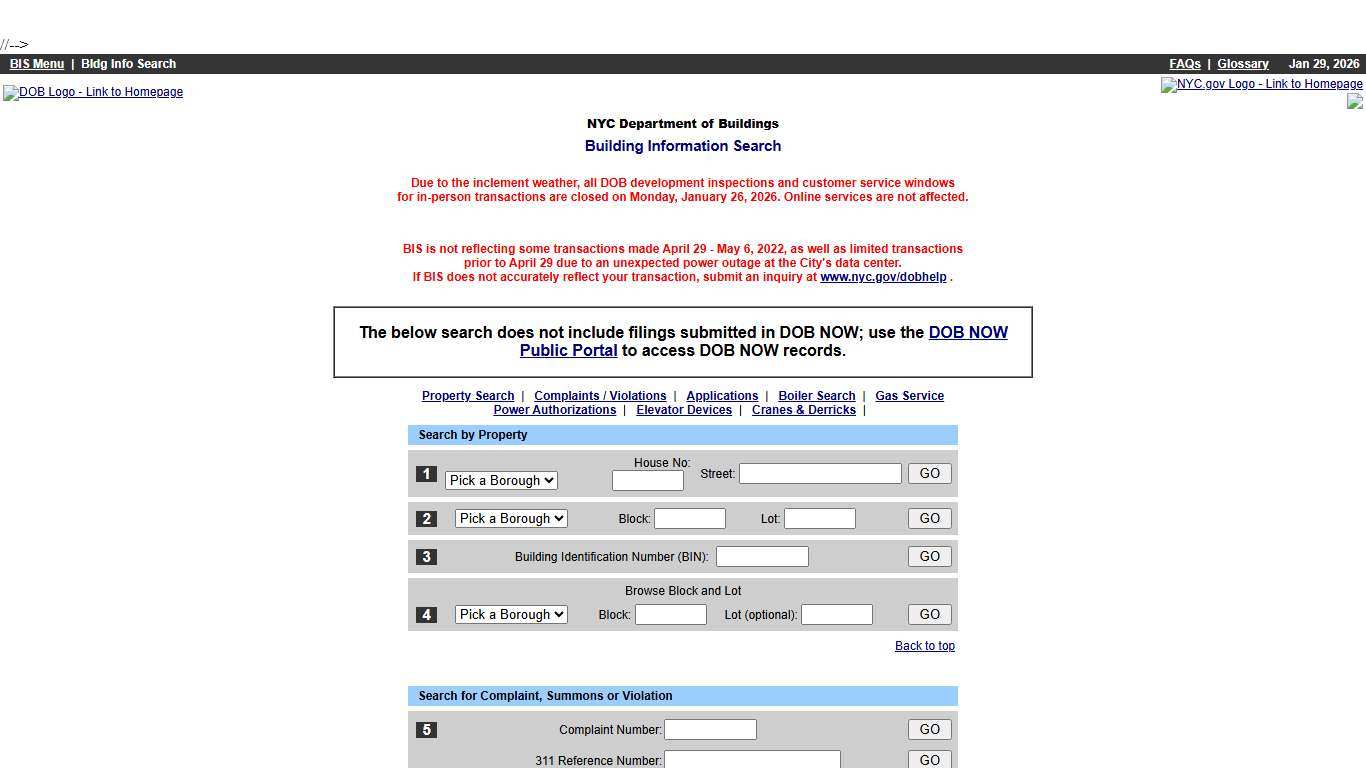

DOB Building Information Search

Due to the inclement weather, all DOB development inspections and customer service windows for in-person transactions are closed on Monday, January 26, 2026. Online services are not affected.

https://a810-bisweb.nyc.gov/bisweb/bispi00.jsp

Public Access > Home

Property Search · 2025 TAXES DUE NOW!! · 2025 TAXES MUST BE PAID OR POSTMARKED BY FEBRUARY 2, 2026 TO AVOID PENALTY AND INTEREST.

https://lubbockcad.org/

Home

Parcels/Business Accounts Administered in 2025 Tax Relief Granted in the 2025 Assessment Roll Disabled Veterans Enrolled in Tax Relief Programs Taxpayer Advocate Cases Resolved in 2025 We will be back to serve you with great customer service on Friday, February 13, 2026.

https://www.sdarcc.gov/

Marty Kiar - Broward County Property Appraiser

Property owners who both owned and made the property their permanent residence after January 1, 2025 may now file for 2026 Homestead Exemption and all other ...

https://bcpa.net/

Foreign Adversary Property Bans Advanced Across 38 States in 2025 MultiState

Legal Here's What You Need To Know About Sports Betting in 2025 and Beyond December 9, 2025 Marvin Yates Key Takeaways: At the end of each year, our policy analysts share insights on the issues that have been at the forefront of state legislatures throughout the session during their review of thousands of bills across all 50 states.

https://www.multistate.us/insider/2026/1/26/foreign-adversary-property-bans-advanced-across-38-states-in-2025

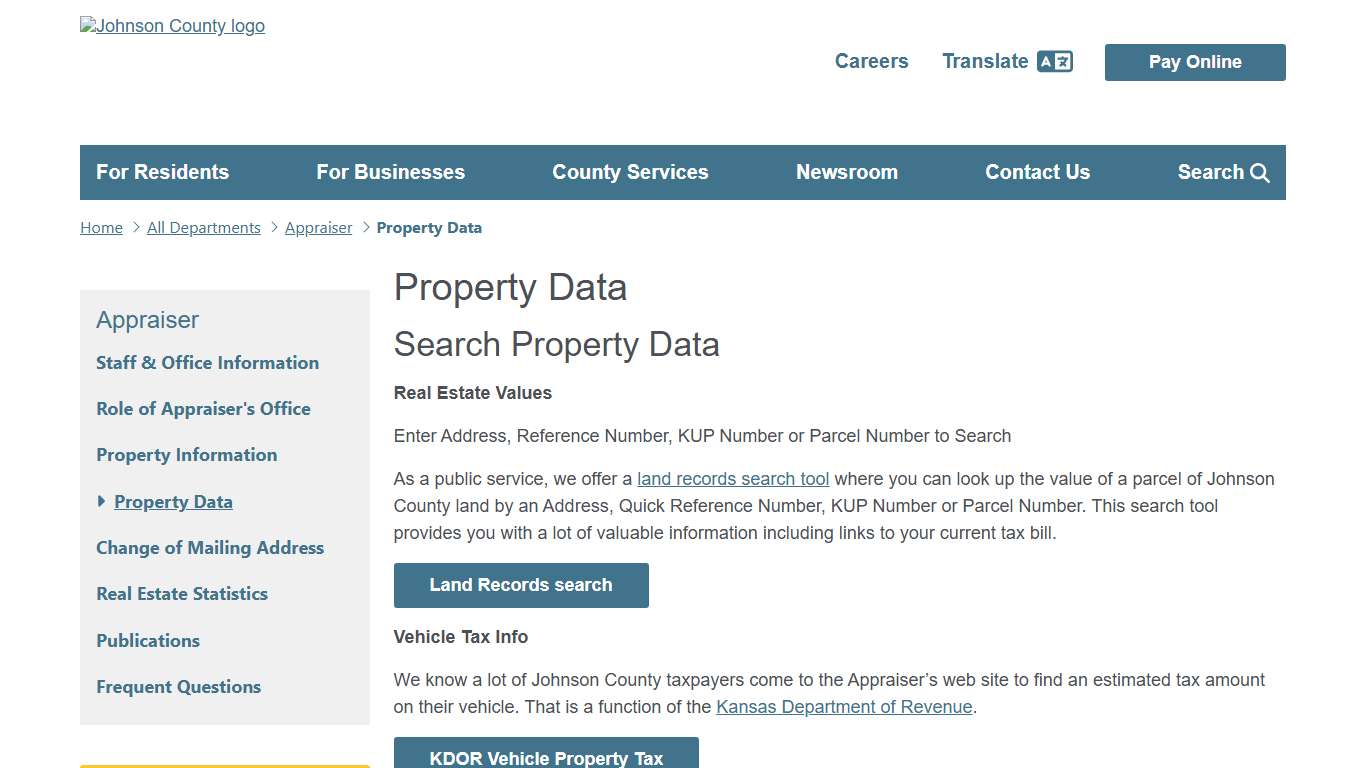

Property Data Johnson County Kansas

Property Data Search Property Data Real Estate Values Enter Address, Reference Number, KUP Number or Parcel Number to Search As a public service, we offer a land records search tool where you can look up the value of a parcel of Johnson County land by an Address, Quick Reference Number, KUP Number or Parcel Number.

https://www.jocogov.org/department/appraiser/property-data

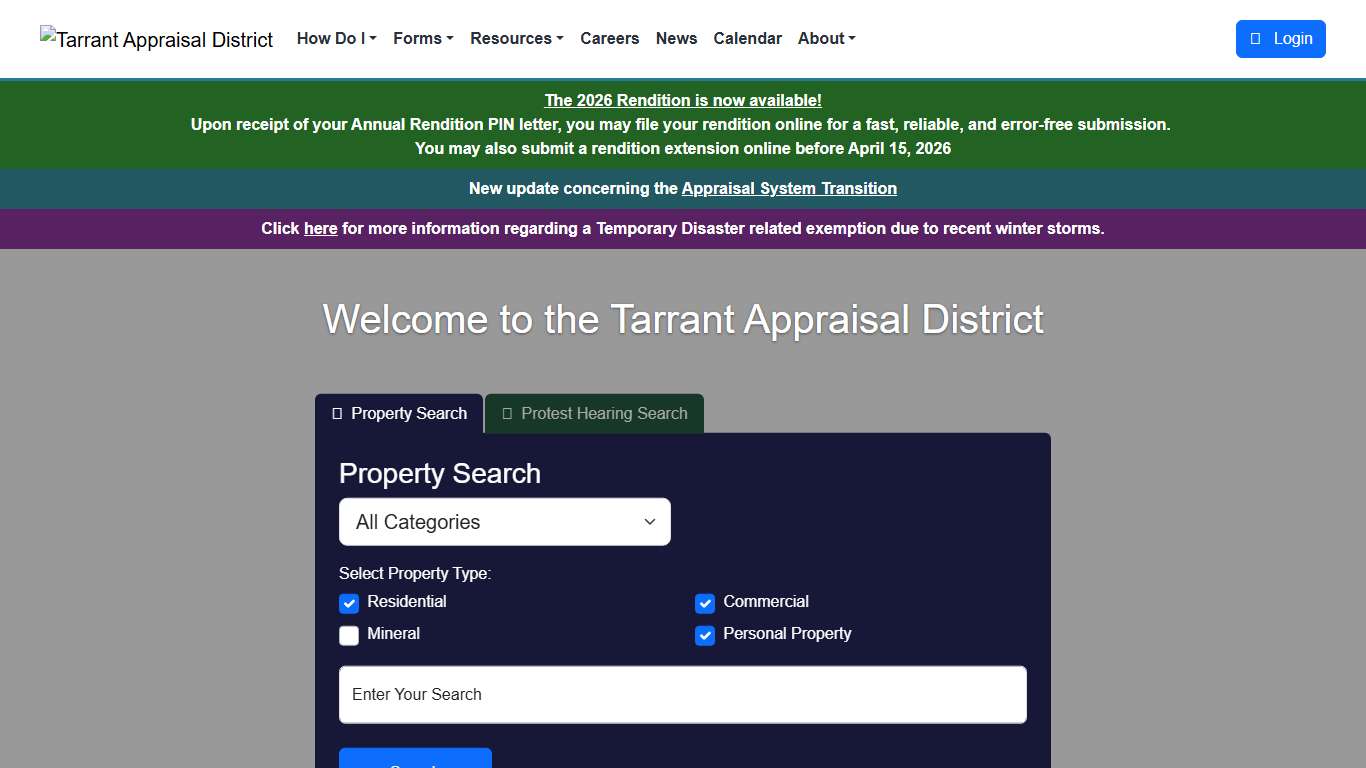

Tarrant Appraisal District

Services We Provide About Us Who We Are Tarrant Appraisal District (TAD) is a political subdivision of the State of Texas created effective January 1, 1980. The provisions of the Texas Property Tax Code govern the legal, statutory, and administrative requirements of the appraisal district.

https://www.tad.org/

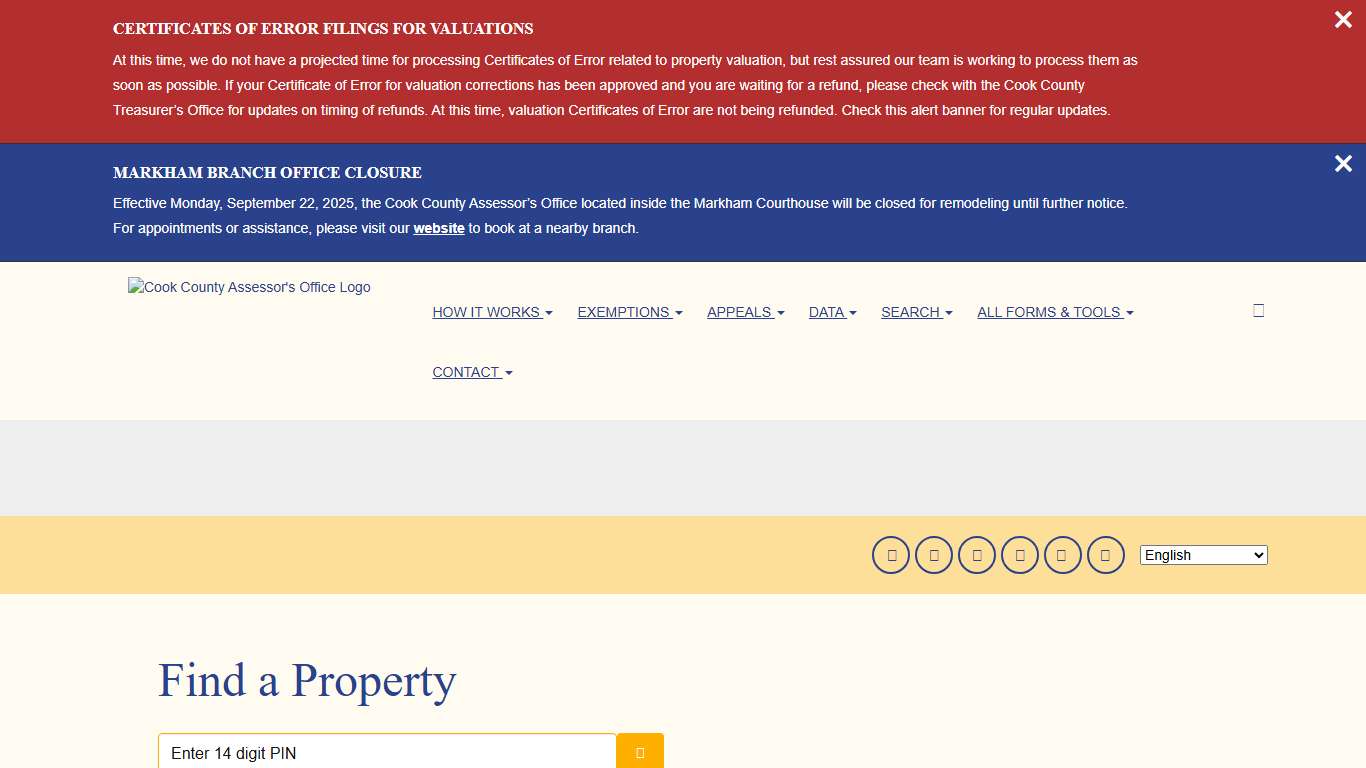

Search by Address Cook County Assessor's Office

Property Class - Select - 2-02: One story residence, any age, up to 999 square feet 2-03: One story residence, any age, 1,000 to 1,800 square feet 2-04: One story residence, any age, 1,801 square feet and over 2-05: Two or more story residence, over 62 years, up to 2,200 sq.ft.

https://www.cookcountyassessoril.gov/address-search

Collin County Tax Assessor: Property Taxes

It is the duty of the Tax Assessor-Collector to assess and collect for the County all taxes imposed on property within the county. Avoid Penalties! Pay property taxes on time. Property Tax Statements are mailed out in October, and are due upon receipt.

https://www.collincountytx.gov/Tax-Assessor/property-taxes